My Wednesday Wish for You: To Be Your Own Best Friend We often push ourselves harder than anyone else ever…

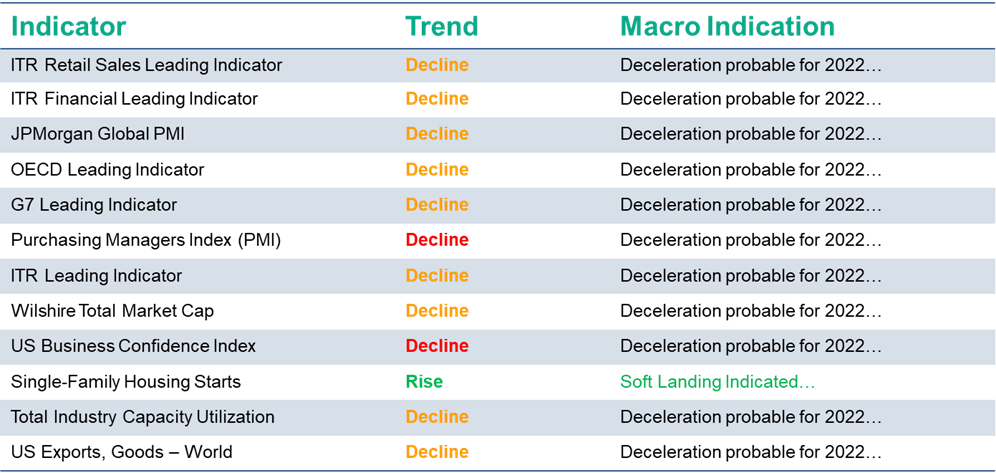

As a leader you wouldn’t use only one piece of data to make a decision, why would you expect to do that regarding the economy?

There is a common desire to pinpoint a cause for an event. Frequently, we are asked:

- Why will the US macroeconomy avoid recession during this business cycle?

- What will be the cause of the next recession?

- Which indicator do I need to follow for my business?

In these moments, it is important to remember that the economy is a symphony. There are many pieces and parts of the economy that intertwine and meld together to make a harmonious sound, and it is rare for there to be one singular cause or indicator. Additionally, if you are watching for just one cause, or following just one indicator, you could get a false signal and steer your business in the wrong direction.

Why You Should Not Follow Just One Leading Indicator

We frequently share the below table during presentations and conversations with our clients. These indicators are a prime example of why you need to listen to the symphony and not just watch the trombone player.

In the past few weeks, we had a tentative false signal from Total Industry Capacity Utilization. The Utilization 1/12 had moved upward for two months, which would put the indicator into a tentative rising trend on the table.

It is a lot easier to be confident about the future when all the indicators are singing the same tune, but when we had Single-Family Housing Starts and Total Industry Capacity Utilization tentatively saying rise, it caused some concerns about what it would mean for the economy, our clients, and our forecasts.

[ Read more: When Leading Indicators Don’t Really Lead ]

A few key takeaways:

- We did a deeper analysis and determined that Total Industry Capacity Utilization was likely to decline, so we adjusted the table.

- Our methodology has been in place for over 70 years, and it has always utilized a collection of indicators to avoid the possibility of any one false signal leading a business to make the wrong move at the wrong time.

- During this business cycle, we expect the macroeconomy (US GDP and US Industrial Production) will go through a period of slowing growth but ultimately avoid recession. However, there are industries (chemicals, mining, and aircraft, to name a few) that will enter recession during this cycle. During these types of cycles, where some markets go into recession while others don’t, it is not uncommon to see the leading indicators be a little less consistent.

There are a lot of indicators to review and a lot of instruments playing in the symphony. Knowing where your business fits in is key to being prepared and capitalizing on the future. If you would like help determining what these indicators mean for you and your business, please don’t hesitate to let us know.